Operating a business in India? Then you better know your stuff when it comes to statutory compliance! It might sound like a big, boring term, but trust us, it's essential for the health of your business. Think of it as your business’s “license to operate”—break the rules, and you could be in serious trouble. Let’s break it down, shall we?

Statutory compliance is just a fancy term for the legal stuff you have to do when you hire and manage employees. In India, there are laws around wages, working conditions, taxes, employee benefits, and more. The key takeaway here? Follow these laws, and you're good. Ignore them, and you're opening the door to a ton of potential problems.

Alright, let's get real for a second. Compliance is not just some legal jargon—it’s about building trust. By staying compliant, you're creating a workplace where employees feel safe, valued, and, most importantly, treated fairly. It’s a win-win: your employees are happy, your business runs smoothly, and you avoid the nasty consequences of non-compliance.

Imagine this: you're busy running your company, managing payroll, hiring new staff, and suddenly—bam! A legal issue hits you because you missed an important regulation. The result? Big fines, lawsuits, or worse—a damaged reputation. Not fun, right? By staying compliant, you’re preventing this disaster from happening.

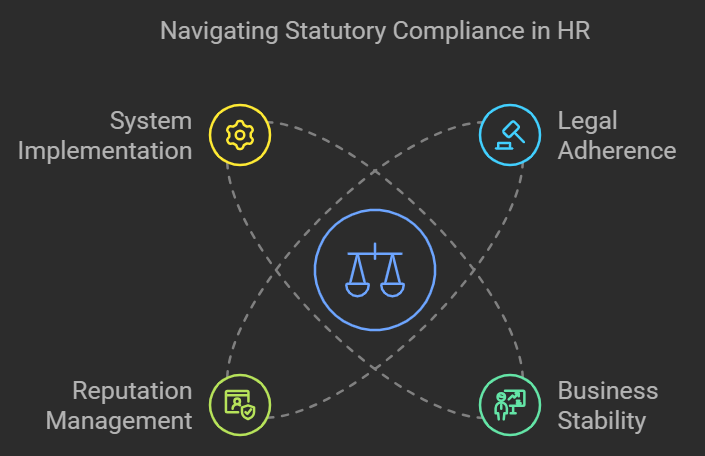

Statutory compliance isn’t just about avoiding penalties—it’s about creating a strong, ethical foundation for your company. Let’s break it down:

It’s simple: employees want to be paid fairly. They want their bonuses, their leave, and proper working conditions. Statutory compliance ensures employees get what they're entitled to. If you're not following the rules, expect unhappy employees and a whole lot of trouble.

Imagine a small manufacturing business in Mumbai. They ignored the Minimum Wages Act and didn’t pay their workers the legally required amount. Long story short: unhappy employees, hefty fines, and a damaged business reputation. All that money could've gone toward growing the company instead.

Non-compliance equals big problems. We're talking fines, lawsuits, and in some cases, criminal charges. For example, missing out on TDS deductions could result in penalties and interest fees. Worse, if you drag your feet on compliance, the courts will make sure you feel the heat.

A logistics company in Pune skipped out on their Provident Fund (PF) contributions. Result? They got hit with hefty fines, and they’re still fighting the legal fallout in court. Ouch.

Your reputation is everything. Businesses with a strong compliance record are seen as responsible and ethical, which attracts top talent. Think of it this way: employees want to work for a company that respects their rights and follows the law.

Companies like Tata Group and Infosys are known for their commitment to compliance. They treat employees well, follow all the rules, and attract the best talent in the country. When your business reputation is solid, customers, employees, and even investors will take notice.

Complying with laws isn’t just about avoiding fines—it’s about reducing risks. As labor laws evolve, it’s crucial to stay updated. If you miss out, you risk audits, penalties, and government investigations. Staying ahead of the curve means you’ll avoid these headaches.

Consider a mid-sized IT company in Bangalore. They expanded to multiple states but failed to keep up with state-specific labor laws. What happened? A government audit, penalties, and a bunch of operational headaches. Lesson learned: stay compliant to avoid chaos.

Now that we know why compliance matters, let’s dive into the key areas you need to focus on:

Every employee should have a clear, signed employment contract. It’s the foundation of your working relationship. Not having one? Bad move. It leaves you open to disputes down the line.

Did you know that minimum wage laws are different for each state in India? Make sure you're paying at least the minimum wage for your industry and location. Failing to do so? Well, that could mean legal trouble and fines.

PF and ESI are social security schemes that protect employees during times of need. It’s your responsibility to contribute to them—don’t skip it. Whether you’re a small business or a large one, your employees are entitled to these benefits.

Tax laws are complicated, and messing up TDS deductions can land you in hot water. Always make sure you're deducting the right amount and paying it on time to avoid penalties and fines.

Employees who have worked for five years are entitled to gratuity. And let’s not forget leave entitlements like sick leave, casual leave, and public holidays. If you're not providing these benefits, you're walking a tightrope with your employees' trust.

Ignoring statutory compliance has consequences. Here's what can go wrong:

Miss a deadline for PF or TDS? Expect fines. The longer you ignore the rules, the higher the penalties. They can quickly eat into your profits.

If you’re not following the laws, employees or the government might take you to court. That means legal fees, stress, and a whole lot of time wasted.

Employees talk, customers notice, and soon your reputation takes a nosedive. Non-compliance can make you look unethical, and in today’s world, that’s a big deal.

Legal issues can disrupt your daily operations. If you’re caught in an audit or lawsuit, expect things to grind to a halt. This can hurt your bottom line and your brand.

Xyntara is here to make your life easier. With automated tracking, accurate calculations, and secure data storage, Xyntara helps you stay compliant without the hassle. Here’s how:

Xyntara sends reminders for deadlines like TDS payments, PF contributions, and ESI submissions. This means you’ll never miss a crucial date again.

Let Xyntara handle the numbers. It does the math for you, ensuring accurate deductions and employee benefits—no more costly mistakes!

All employee records and compliance documents are safely stored in Xyntara. When audit time comes, you’ll be ready to roll with everything in place.

Statutory compliance may not be the most exciting topic, but it’s essential for the smooth operation of your business. By staying on top of the rules, you can avoid headaches and focus on growing your business while creating a better workplace for your employees. So, take compliance seriously—your business and employees will thank you!